It is no surprise that the owners of Mixx.com are excited to announce that Mixx was recently acquired by UberMedia, which will allow them to continue to give members a way to fine tune social media to their own interests. UberMedia is parent to variety of products like UberSocial, Echofon, and Twidroyd, and run by a team of rock stars who state they are determined to help make Mixx better than ever. Its predicted that this acquistion will require some radical changes but some believe these M&As are planned years in advance. We all know, social media is constantly evolving, and Mixx has to evolve as well. In short, they have shutdownn Mixx Classic and will be relaunching with a new Mixx product sometime soon.

Visit http://www.mixx.com/ give them your email address and you can be the first on your block to try out the new Mixx!

One of the primary growth drivers is digital technology. Utilities, health, communication, and other industry sectors are rapidly evolving in complex and interconnected ways. This blog offers a unique perspective to compliment information on sites such as www.finance.yahoo.com, www.google.com/finance and money.msn.com.

Sunday, April 17, 2011

Monday, March 7, 2011

The Digital in Business Cycle

All business experience distinct cycles of economic growth, inflation and employment. In fact, some business exist to publish hundreds business-cycle indexes for all the major economies (i.e. United State, China and India.) For example, you often read about U.S. Weekly Leading Index (WLI).

Sources such as the The Economist, will provide information about organizations that provide advance warning of possible recessions, some are impressively accurate and some are false alarms. To no real surprise many business indexes indicate that U.S. economic growth will accelerate this year.

There are less reasons to worry about a fragile economy at this time, and there is little reason to worry about inflation-or deflation according to market researchers.

Personally, it appears the federal policy is hyper-stimulative and a new boom-bust cycle in the years ahead is mandatory because anything else would be riot inducing.

This is based on intelligence received from secretive collaboration between Global Investment Strategist and International Economist about the economy, inflation, home prices, jobs and the Fed. To purchase copies of the un-edited version of their conversation send request to dml.e3d1@gmail.com

For more information of the subject matter, please consider the following sources;

Sources such as the The Economist, will provide information about organizations that provide advance warning of possible recessions, some are impressively accurate and some are false alarms. To no real surprise many business indexes indicate that U.S. economic growth will accelerate this year.

There are less reasons to worry about a fragile economy at this time, and there is little reason to worry about inflation-or deflation according to market researchers.

Personally, it appears the federal policy is hyper-stimulative and a new boom-bust cycle in the years ahead is mandatory because anything else would be riot inducing.

This is based on intelligence received from secretive collaboration between Global Investment Strategist and International Economist about the economy, inflation, home prices, jobs and the Fed. To purchase copies of the un-edited version of their conversation send request to dml.e3d1@gmail.com

For more information of the subject matter, please consider the following sources;

.

Sunday, March 6, 2011

3 minute video describing your business idea

The Investor has capital (i.e. in increments of $2.5 million) the landowners has over 400 acres of scattered real estate. The agreement to utilize the land for electric energy generation or tree farms (i.e. five revenue streams - honey, roots, ointment, wood, carbon credits). LOI or videos should be sent to dml.e3d1@gmail.com.

Serious Principals Only!

Serious Principals Only!

Monday, February 28, 2011

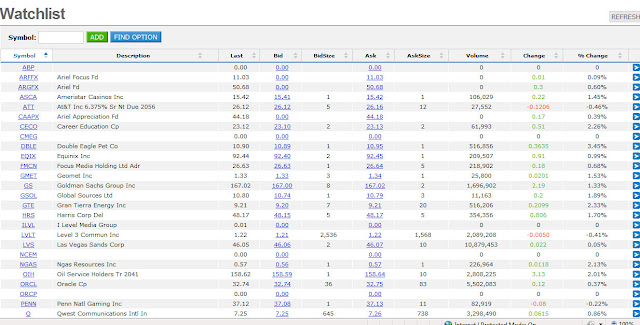

TradingWolf Watchlist:Oak Capital Group

The following information was forwarded to DTI for peer review consideration. Basically the sender would like to know if any of DTI visitors have worked with this organization? Please post comments if you have any information that you deem helpful to the sender as well as other visitors.

-------------------------------------------------

Oak Capital Group

Most small business owners are optimists by nature and find the silver lining in most situations. The news media doesn’t help keep spirits up but here are a few articles that highlight an improving business climate.

- 41% of Small Businesses More Confident Than a Year Ago (PR Newswire)

- Businesses Are Borrowing Again (ABC News)

- Helping Small Businesses Access Capital (US Treasury Office)

Oak Capital Group has continued to support the small to mid-sized business with a strong funding roster in the month of Feb. Here are some highlights:

· $165,000 : An owner of four Burger King locations on the West Coast needed $165,000 to upgrade the point of sale systems (hardware and software) to comply with franchise standards. The locations had suffered from declining revenues the last 2 years. We structured a $3,500 monthly payment with a minimal upfront cost.

· $20,000: An East Coast based moving company needed to add an additional box truck to their fleet. We funded approximately $20,000 for a late 90’s model with an affordable payment and quick funding.

· $750,000 Equipment Line of Credit: A Los Angeles based provider of data storage solutions is currently building a server farm in the downtown area and presented us with over $750,000 of needs for the next three quarters. We funded the gear immediately needed for delivery and established an equipment line of credit for future purchasing needs.

Why Oak Capital Group?

Our customers get access to the best possible rates, fast turnaround, and everything we touch is hand reviewed by an expert credit team that knows how to assess the credit situation of your particular business. We work closely with a syndicate network of bank partners to ensure that the largest possible range of credits can be accepted. Translation - we can provide higher approval ratios than almost any other lender.

Call us today and we can discuss what capital project you have planned for your business.

Andre Olaofe

818-936-3585 Direct

877-264-7007 x 1002 Toll Free

877-887-5116 FAX

424-226-2233 Cell

WHAT DOES MY BUSINESS CREDIT LOOK LIKE? More and more it is important to pay attention to your company’s business credit profile. Sometimes this can be the only information we need to approve you for an equipment loan or lease. Click here to request your company’s report absolutely FREE.

Friday, February 25, 2011

TradingWolf Watchlist:WILSON LOANS & FINANCIAL INVESTMENT

The following information was forwarded to DTI for peer review consideration. Basically the sender would like to know if any of DTI visitors have worked with this organization? Please post comments if you have any information that you deem helpful to the sender as well as other visitors.

-------------------------------------------------

WILSON LOANS & FINANCIAL INVESTMENT

Wilson Loans and Financial Investment, a Private Loan Lender and a

cooperate financier for real estate and any kinds of business financing.

We also offer Loans to individuals, Firms and cooperate bodies at low

interest rate , loan terms determinant,Loan amount between the sum of

$2,500.00 to $100,000,000.00 US Dollars. Loan for developing businesses a

competitive edge/ business expansion.

We Offer The Following Kinds Of Loans

* Personal Loans

* Business Loans

* Consolidation Loan

FIRST INFORMATIONS NEEDED ARE:

Name(Mr., Mrs., Ms., Dr., etc.): .........

Date of birth (yyyy-mm-dd): ...........

Gender:................................

Amount Needed:......................

Time Duration ............

Address: ..........................

Country: ...........

Phone: .............

Monthly Income ...................

Occupation: ..........

E-mail:wilsonfinance2@yahoo.com.hk

THERE IS NOTHING TO LOSE BUT YOUR DEBT AND FINANCIAL PROBLEMS

High profit video games - a good digital content forecast.

Don't take my word for it, hear it from a industry leader in the gaming industry, http://www.reuters.com/news/video?videoId=165724105 - Take-Two Interactive Chairman Strauss Zelnick told Reuters that digitally downloaded video games could account for up to 25% of revenues over time.

Don't take my word for it, hear it from a industry leader in the gaming industry, http://www.reuters.com/news/video?videoId=165724105 - Take-Two Interactive Chairman Strauss Zelnick told Reuters that digitally downloaded video games could account for up to 25% of revenues over time.Thursday, February 24, 2011

A guide to small business financing? by NAGC

The following information was sent in by a colleague that was curious whether these types of product and services offering are effective. Please review and share your comments or perspective.

Guide to Small Business Finance

NEW DISCOUNTED PRICE!

New small business lending legislation has opened up new opportunities to finance business growth. Learn how to finance business startups and expansion of an existing business with our Guide to Small Business Finance. For companies seeking immediate financing, we also offer a loan product for loans of up to $2 Million through Merchant Advisors.

P.S. As an added bonus, your registration comes with a three-month trial membership with the National Association of Government Contractors! NAGC offers a variety of benefits to small businesses. View Member Benefits

DO YOU NEED FINANCING NOW? WE PROVIDE LOANS OF UP TO $2 MILLION

Wednesday, February 23, 2011

2010 New Markets Tax Credit (NMTC) Program awards in Baltimore on Thursday, February 24 at 11 a.m.

Can you make this event? If you do please share your experience via comments.

WASHINGTON, D.C. – February 23, 2011 - Community Development Financial Institutions (CDFI) Fund Director Donna Gambrell and Congressman Elijah Cummings will announce the 2010 New Markets Tax Credit (NMTC) Program awards in Baltimore on Thursday, February 24 at 11 a.m. Eastern Time.

The announcement will be made at Humanim, a not-for-profit organization that provides workfhorce development services to low-income individuals. The CDFI Fund says that Humanim Inc., having benefitted from the NMTC, highlights the effectiveness of the new markets tax credit in leveraging private investment to complete real estate, local business and other development projects in communities with high rates of poverty and unemployment. Four Baltimore-area institutions will receive tax allocations under the program in this NMTC award round.

More information will be available at www.newmarketscredits.com after the awards announcement.

For more information about Novogradac & Company LLP's upcoming events:

http://www.novoco.com/events/

For more information about Novogradac & Company LLP's products and publications:

http://www.novoco.com/products/

The announcement will be made at Humanim, a not-for-profit organization that provides workfhorce development services to low-income individuals. The CDFI Fund says that Humanim Inc., having benefitted from the NMTC, highlights the effectiveness of the new markets tax credit in leveraging private investment to complete real estate, local business and other development projects in communities with high rates of poverty and unemployment. Four Baltimore-area institutions will receive tax allocations under the program in this NMTC award round.

More information will be available at www.newmarketscredits.com after the awards announcement.

For more information about Novogradac & Company LLP's upcoming events:

http://www.novoco.com/events/

For more information about Novogradac & Company LLP's products and publications:

http://www.novoco.com/products/

A Foundation Seeking Partnerships

A non-profit foundation is looking for partnerships that would allow them to complete many of the listed initiatives. Comments are welcome!

Tuesday, February 22, 2011

Monday, February 21, 2011

Investor Wanted Series: Project - Digital Content Unlimited

As a member of DTI, I am also interested in an investor. I own a company that works with applications for digital ttechnologies and my business partner owns a company that works with electronic sensing, relaying and communicating techniques. We have just joined forces but need capital in our combined industries to continue to grow and expand. As part of our expansion we will launch a Content Management Division that will provide the necessary marketing and advertisement resources to maximize market penetration. However, without the capitol to get larger contracts, better technology, and more workers we basically have plateaued.

Scenario A: Bigger contracts require you to have communication network with approximately 6 to 10 thousand feet of cat5e and cat6 with all the other products. Our sensors and relaying equipment are suitable for such small installations but the 30% deposits (offered in current procurement notices) are not nearly enough to meet all the material and labor requirements.

Scenario B: When you get a contract to completely re-due the entire marketing and business profitability of about 10 companies. We need to produce samples, presentations and get approvals but to get those samples and eventually to execute the project you need re-model our existing free and clear operations, warehouse and studio video production space which could also be rented for $250 bucks an hour. Ideally, can save that $250 bucks an hour we can potentially reduce the overall cost to our new clients and secure numerious proposals and be effective moving forward.

I'm looking for a few Venture Capitalist or Angel Investors to invest $2.5 M to 5M so within the next 24 to 36 months to complete a very agressive merger and acquision strategy in the Washington D.C. market. Basically, the content demand in the Washington area is scheduled to triple based on upcoming events and we are positioned to provide 5 times the invested amounts once the deliver and deployment of the content and service devilery is completed.

Scenario A: Bigger contracts require you to have communication network with approximately 6 to 10 thousand feet of cat5e and cat6 with all the other products. Our sensors and relaying equipment are suitable for such small installations but the 30% deposits (offered in current procurement notices) are not nearly enough to meet all the material and labor requirements.

Scenario B: When you get a contract to completely re-due the entire marketing and business profitability of about 10 companies. We need to produce samples, presentations and get approvals but to get those samples and eventually to execute the project you need re-model our existing free and clear operations, warehouse and studio video production space which could also be rented for $250 bucks an hour. Ideally, can save that $250 bucks an hour we can potentially reduce the overall cost to our new clients and secure numerious proposals and be effective moving forward.

I'm looking for a few Venture Capitalist or Angel Investors to invest $2.5 M to 5M so within the next 24 to 36 months to complete a very agressive merger and acquision strategy in the Washington D.C. market. Basically, the content demand in the Washington area is scheduled to triple based on upcoming events and we are positioned to provide 5 times the invested amounts once the deliver and deployment of the content and service devilery is completed.

If you are interested please send interest information to dml.e3d1@gmail.com.

Investors Wanted : Initiative A - Electric Energy Farms (Update)

The tree project is a division of a STG EcoSystem Program which requires a minimum of 40 acres. Depending on the land footprint and location the program is projected to gross a minimum of $800,000 to $900,000 annually after the first harvest..

- - Favorable Tax Environment for Investors

- - Solution to Climate Change

- - Source of Clean, Renewable Energy

- - Carbon, Smart Grid and Broadband markets

- - Grants and Low-interest loans

- - Financial sustainability

Please see that included images for information required for consideration into the Program.

Sunday, February 20, 2011

Investors Wanted : Initiative A - Electric Energy Farms

Brief Overview:

Over 400 acres of scattered real estate to be converted to electric energy farms. Projected revenue after 18 months is $1 million with a annual increase of 20% each year thereafter. Developers are requesting 20% matching funds from the land owners and the DOE is offering 80% funding support in form of forgivable loans or grants. Investors terms and conditions can be sent to dml.e3d1@gmail.com. Comments are welcome and further details posted exclusively on this blog for maximum transparency to all interested stakeholders.

Over 400 acres of scattered real estate to be converted to electric energy farms. Projected revenue after 18 months is $1 million with a annual increase of 20% each year thereafter. Developers are requesting 20% matching funds from the land owners and the DOE is offering 80% funding support in form of forgivable loans or grants. Investors terms and conditions can be sent to dml.e3d1@gmail.com. Comments are welcome and further details posted exclusively on this blog for maximum transparency to all interested stakeholders.

Sunday, February 13, 2011

Merger & Acquistion: 1st Quarter 2011

Analysts and other sources suggest M&A could move into areas like e-commerce, enterprise intelligence, and web-based diagnostics, and have named CommVault (NASDAQ:CVLT), MicroStrategy (NASDAQ:MSTR), Open Text (TO:OTC), and RightNow (NASDAQ:RNOW) as prospects.

Digital technology firms will compete to acquire niche software groups well into 2011 as part of a expansion strategy they hope will seek and acquire recession-hit clients seeking recover and expand as well.

And with revenues returning to growth, they have pockets full of cash at their disposal.

Leading this trend is companies, such as IBM (NYSE:IBM) and Oracle (NASDAQ:ORCL), who are buying specialist software makers so they can offer more to corporate customers. It is reported that Oracle alone has spent more than $42 billion on acquisitions over the past six years, and it had $10.4 billion in cash at the end of November.

Basically, with revenues recovering, enterprises need to find a use for this money, and they are looking to place bets on emerging digital technologies.

Digital technology firms will compete to acquire niche software groups well into 2011 as part of a expansion strategy they hope will seek and acquire recession-hit clients seeking recover and expand as well.

And with revenues returning to growth, they have pockets full of cash at their disposal.

Leading this trend is companies, such as IBM (NYSE:IBM) and Oracle (NASDAQ:ORCL), who are buying specialist software makers so they can offer more to corporate customers. It is reported that Oracle alone has spent more than $42 billion on acquisitions over the past six years, and it had $10.4 billion in cash at the end of November.

Basically, with revenues recovering, enterprises need to find a use for this money, and they are looking to place bets on emerging digital technologies.

Saturday, February 12, 2011

As digital data grows beyond exabyte

An exabyte (derived from the SI prefix exa-) is a unit of information or computer storage equal to one quintillion bytes (short scale). The unit symbol for the exabyte is EB. When used with byte multiples, the unit indicates a power of 1000:

Companies like Isilon Systems seeks to control the management of this enormous industry and based on the 52 week constant increase in stock price its a great time to invest.

Please note, Isilon Systems, Inc. (NASDAQ: ISLN) sells clustered data storage devices specialized for digital content such as images and videos. The company's clustered systems cater to the growth in digital data, such as images from scientific research and high-resolution videos from the media industry. Falling product prices per unit of storage capacity in the data storage market, in addition to the rapid increase in the amount of digital data that organizations are storing, have maintained the demand for Isilon's products. Its customers range from small and medium businesses to Fortune 500 companies. Unlike traditional data storage systems, a clustered data storage system combines the processing power and storage capacity of multiple, smaller storage servers. This increases the scalability of the storage system, since an information communication technology (ICT) organization can add additional storage servers as needed.

- 1 EB = 1,000,000,000,000,000,000 B = 1018 bytes = 1 billion gigabytes = 1 million terabytes

Companies like Isilon Systems seeks to control the management of this enormous industry and based on the 52 week constant increase in stock price its a great time to invest.

Please note, Isilon Systems, Inc. (NASDAQ: ISLN) sells clustered data storage devices specialized for digital content such as images and videos. The company's clustered systems cater to the growth in digital data, such as images from scientific research and high-resolution videos from the media industry. Falling product prices per unit of storage capacity in the data storage market, in addition to the rapid increase in the amount of digital data that organizations are storing, have maintained the demand for Isilon's products. Its customers range from small and medium businesses to Fortune 500 companies. Unlike traditional data storage systems, a clustered data storage system combines the processing power and storage capacity of multiple, smaller storage servers. This increases the scalability of the storage system, since an information communication technology (ICT) organization can add additional storage servers as needed.

Friday, February 11, 2011

The Allure of Utility Computing: Unmet!

Unlike traditional data, such as e-mails, word documents, and accounting spreadsheets, digital content requires additional storage features, such as the ability to let multiple users access the same file at the same time. Clustered storage systems combine the data storage capacity of multiple file servers, called nodes, with an operating system that integrates the data stored on the separate servers. This data storage system is both scalable, since ICT personnel can add additional nodes as needed, and reliable, since a user's data is not all gathered in one physical location.

On the hardware side the products are file servers that can store terabytes of data (1 terabyte = 1000 gigabytes). What differentiates these servers is the trademark built-in operating system software that integrates the data from all of the separate nodes, which leads to the additional features that digital content requires.

The organizations working in media & entertainment, Internet, cable/telecommunications, energy, life sciences/health care and manufacturing industries, as well as intelligence gathering operations of the federal government are mainly interested in this level of product and services. The size of clients range from small/medium business to Fortune 500 corporations that don't want a long-term contract. But what about the individuals that need utility computing to address daily challenges. This is not a new concept but definitely a concept that has not been addressed. We have spoken with venture capitalist that will provide at least $1 million in investment capital for a company that can meet this individual demand requirements.

For more information and insight regarding the potential promise and unmet demand then consider purchasing and reviewing the following sources;

On the hardware side the products are file servers that can store terabytes of data (1 terabyte = 1000 gigabytes). What differentiates these servers is the trademark built-in operating system software that integrates the data from all of the separate nodes, which leads to the additional features that digital content requires.

On the software side the vendor provides ancillary computer software applications that enhance or take advantage of the system of integrated, but separate, file servers. These application include disaster recovery disk-to-disk backup, load balancing (distributing traffic so that a single file server is not overloaded), and data management applications.

The organizations working in media & entertainment, Internet, cable/telecommunications, energy, life sciences/health care and manufacturing industries, as well as intelligence gathering operations of the federal government are mainly interested in this level of product and services. The size of clients range from small/medium business to Fortune 500 corporations that don't want a long-term contract. But what about the individuals that need utility computing to address daily challenges. This is not a new concept but definitely a concept that has not been addressed. We have spoken with venture capitalist that will provide at least $1 million in investment capital for a company that can meet this individual demand requirements.

For more information and insight regarding the potential promise and unmet demand then consider purchasing and reviewing the following sources;

Monday, February 7, 2011

Sunday, February 6, 2011

As political parties play friends - telecommunication providers play foes!

Verizon is attacking AT&T and vice versa. T-Mobile is attacking both of them. Sprint does not have much to fight about at this juncture but that will change as LTE and WiMAX adoption increase.

Among the more recent attack ads was one from Verizon touting the sound quality of its iPhone. Now, AT&T is firing back at Verizon with an ad touting the benefits of talking and surfing the Web at the same time.

As indicated below both Verizon and AT&T stock are down at the time of this post but perhaps that respresent opportunities for investors.

Among the more recent attack ads was one from Verizon touting the sound quality of its iPhone. Now, AT&T is firing back at Verizon with an ad touting the benefits of talking and surfing the Web at the same time.

As indicated below both Verizon and AT&T stock are down at the time of this post but perhaps that respresent opportunities for investors.

| Symbol | % Chg | Mkt Cap |

|---|---|---|

| VZ | 102.65B | |

| T | 165.33B |

Datacenter Giant under investigation

(“Terremark” or the “Company”) (NASDAQ:TMRK - News) related to the Company’s agreement to be acquired by Verizon Communications Inc. (“Verizon”). The proposed transaction is valued at approximately $1.4 billion. Terremark shareholders will receive $19.00 in cash per share for a total transaction value of $1.4 billion. Verizon also entered into agreements with three Terremark stockholders to tender their shares into the offer, representing approximately 27.6 percent of the outstanding voting shares of Terremark.

(“Terremark” or the “Company”) (NASDAQ:TMRK - News) related to the Company’s agreement to be acquired by Verizon Communications Inc. (“Verizon”). The proposed transaction is valued at approximately $1.4 billion. Terremark shareholders will receive $19.00 in cash per share for a total transaction value of $1.4 billion. Verizon also entered into agreements with three Terremark stockholders to tender their shares into the offer, representing approximately 27.6 percent of the outstanding voting shares of Terremark. The investigation concerns whether the Terremark Board of Directors breached their fiduciary duties to Terremark stockholders by failing to adequately shop the Company before entering into this transaction and whether Verizon is underpaying for Terremark shares, thus unlawfully harming Terremark stockholders.

This is one worth watching because the final organization will dominate the digital service delivery market. Buying Verizon Communications Inc. Com (NYSE: VZ ) After Hours: 36.29

Saturday, February 5, 2011

Want to invest in big names?

As of today, you’d need $34,664 to invest in Apple Inc. (NasdaqGS: AAPL), $41,100 to invest in General Electric (NYSE: GE), and $61,140 to invest in Google Inc. (NasdaqGS: GOOG). That’s because while the unit price is within reach of most people ($346, $20.55, and $611.40 respectively), you have to buy shares in bulk (100, 2,000, and 100 respectively).

With those sums in today’s market, you could buy a foreclosed house. On the other hand, President Obama just recently asked General Electric Chief Executive Jeffrey Immelt to lead

the President's Council on Jobs and Competitiveness. Opinion is divided on the value of GE stock, but long-term GE appears to have an inside lane.

With those sums in today’s market, you could buy a foreclosed house. On the other hand, President Obama just recently asked General Electric Chief Executive Jeffrey Immelt to lead

the President's Council on Jobs and Competitiveness. Opinion is divided on the value of GE stock, but long-term GE appears to have an inside lane.

About us

One of the primary drivers of growth is digital technology. Energy, utility, health, communication, and other technology infused sectors are rapidly evolving in complex and interconnected ways, creating significant short- and long-term investment opportunities. This blog offers stock picks, investing advice, and analysis of trends designed to compliment those found on established sites such as http://www.finance.yahoo.com/, http://www.google.com/finance and http://money.msn.com/

Subscribe to:

Posts (Atom)